blogBy Toyow Research Team10 April 2025

Tokenized fractional ownership: The Internet's Next Investment Model

The internet is not just a place we visit anymore. It is something we shape, build, and now, even own.

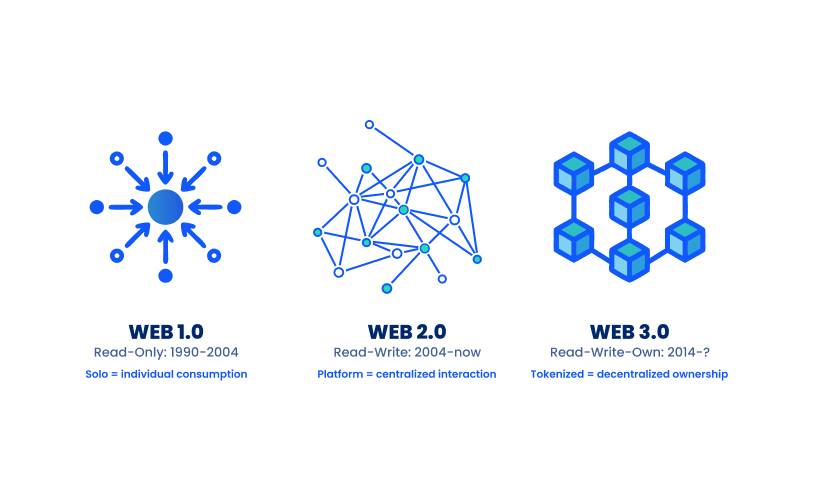

We have come a long way from the dial-up days of static web pages. Web1 was about reading. Web2 gave us the power to like, comment, and share. Web3 takes that a step further by introducing ownership, where users do not just interact, they can hold a piece of value.

At its core, this shift is changing how we think about online participation and who gets access to ownership. This is not just about technology. It is about how ownership can be structured, represented, and transferred in a digital-first world.

In this blog, we explain tokenized fractional ownership: what fractional ownership is, what tokenization is, and why the combination can make ownership easier to manage and more accessible.

What is Fractional Ownership

Fractional ownership lets multiple people pool resources to acquire an asset, with each person owning a share and participating in the asset's outcomes. That could mean co-owning a home, a painting, or even access rights tied to an aircraft.

Take aviation as an example. Owning a jet is unrealistic for most people, but fractional models make it possible to own a share and access flight hours. It is still premium, but far more accessible.

A 2024 OECD report notes that real wages for middle- and lower-income groups have mostly stayed flat, while the cost of large assets, like homes and cars, keeps climbing. That affordability gap is one reason fractional ownership continues to grow.

"What is Tokenization?"

Tokenization can make fractional ownership easier to administer. It can represent defined ownership rights as digital tokens recorded on a blockchain.

These tokens can be easier to store and transfer, with clearer records and fewer administrative steps.

To make this concrete, imagine this: you are sipping your morning coffee while, across the country, a building is earning rent. You do not hold a paper deed. Instead, you hold a token recorded onchain that represents your share in that property, as defined by the relevant documentation.

Is This Happening in the Real World?

Yes. Tokenized fractional ownership is increasingly being used to make ownership and access easier to manage, with more transparent participation and simpler transfers.

Across sectors such as culture, real estate, and commodities, tokenization is moving beyond theory into real-world implementation.

Making Tokenized Ownership Accessible

As this space grows, a practical question emerges: where do people discover these opportunities in one place?

In most categories, users do not want to jump between platforms. They want a clear, trusted destination.

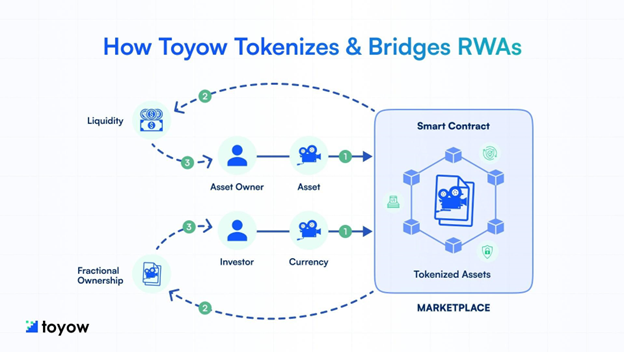

Toyow is structured as a multi-category, primary marketplace designed to help asset issuers structure, tokenize, and launch real-world assets, with a focus on clarity, trust, and compliant access.

How Toyow Supports Tokenization

Asset issuers bring assets to Toyow. The platform supports the tokenization process, helps structure the listing, and makes it available in fractional form.

Users receive digital proof of ownership recorded onchain. Issuers benefit from broader distribution, improved transparency, and a modern ownership format that can support new types of participation.

Final Words

This is still an early chapter in building ownership systems that work at internet scale.

While tokenized fractional ownership shows significant promise, regulations are still evolving, and user protections and disclosure standards must continue to mature.

But progress is underway. Across major markets, clearer rules are emerging for how tokenized assets can be issued and accessed responsibly.

Tokenized fractional ownership offers a new way to structure ownership and participation in real assets. As the ecosystem matures, the winning models will be those built for trust, transparency, and long-term utility.