blogBy Toyow Research Team14 December 2025

The Alpha Pivot: Why Capital is Migrating from "Safety" to "Growth" in 2026

The Dawn of the Residency Era

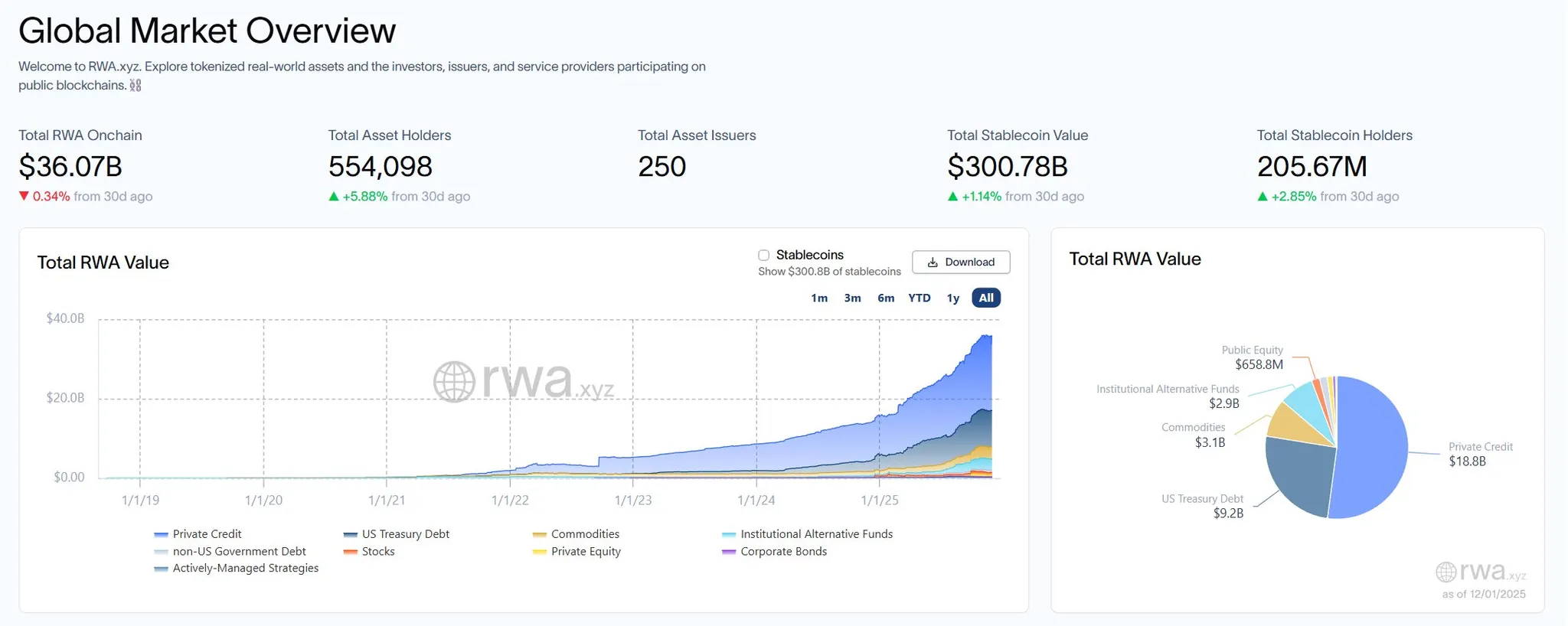

As we close Q4 2025, the debate regarding the viability of Real-World Assets (RWAs) is shifting from "if" to "how fast." The global tokenized RWA market (excluding stablecoins) has surpassed ~$36.07 billion in Total Value Locked (TVL), depending on classification methodology.

For the past two years, traditional financial institutions treated blockchains as a destination for isolated pilots and proofs-of-concept. That phase is giving way to deeper operational adoption.

However, a structural analysis of this market reveals a system still weighted toward one side of the risk spectrum. As we look toward 2026, the narrative is shifting from establishing safety to expanding diversified, real-economy exposure.

The Wireframe vs. The Render

To understand the current market structure, consider the difference between a wireframe and a final render in visual effects.

In 2024, the RWA sector was a wireframe: a structural skeleton of protocols and legal theories without the texture of liquidity. In 2025, major institutions applied "texture" by bringing U.S. Treasuries onchain. Products like BUIDL helped provide the "lighting" of institutional credibility.

But a render is incomplete if it only depicts one object.

Currently, a meaningful share of the RWA market is dominated by tokenized sovereign-grade instruments. This is the "Safety" (or Beta) layer of the onchain economy. While essential for capital preservation, it does not offer the diversification required for a balanced portfolio.

The market is now demanding the rest of the scene: the Growth (Alpha) layer.

The Data: A Bifurcated Market

The onchain data from Q4 2025 highlights appetite for diversification:

- Total RWA TVL: ~$36.07B

- Tokenized Treasuries: ~$9.2B

- Private Credit: ~$18.8B

Why 2026 Belongs to “Alpha” Assets

The liquidity bandwidth established by stablecoins and tokenized Treasuries in 2025 has paved the way for more complex asset tokenization in 2026.

Toyow's focus on commercial real estate, media, and commodities reflects this demand for diversification. Unlike Treasuries, these asset classes can offer:

1. Inflation Hedging: Physical assets have historically behaved differently than fixed-rate debt in inflationary regimes.

2. Uncorrelated Cash Flows: Revenue from film IP or commercial rental yield is not directly tied to Federal Reserve interest rate policy.

3. Fractional Access: Assets that were previously illiquid can be structured into smaller ownership units.

The Compliance and Trust Layer

As tokenization expands into real-world assets, trust becomes the primary constraint.

Institutional-grade adoption depends on clear legal structuring, robust disclosures, and compliance-first user flows. The platforms that scale will be those designed to operate within permitted jurisdictions, with appropriate controls and policies across onboarding, asset structuring, and secondary transfer constraints where applicable.

Toyow's approach reflects this reality: building a compliance-first marketplace experience intended to support regulated participation as frameworks mature globally.

Outlook

The "Safety" layer of the RWA market has been built. The "Growth" layer is being built now.

As we move into 2026, the winners will not be the platforms simply mirroring debt markets, but those unlocking the trillions in illiquid physical value that traditional markets have historically left underserved.